The Best Guide To Stonewell Bookkeeping

Wiki Article

The smart Trick of Stonewell Bookkeeping That Nobody is Discussing

Table of ContentsGetting The Stonewell Bookkeeping To WorkNot known Factual Statements About Stonewell Bookkeeping Stonewell Bookkeeping Fundamentals ExplainedExcitement About Stonewell BookkeepingHow Stonewell Bookkeeping can Save You Time, Stress, and Money.

As opposed to undergoing a filing cupboard of various records, invoices, and receipts, you can offer comprehensive documents to your accountant. Subsequently, you and your accountant can conserve time. As an included bonus offer, you may even have the ability to recognize prospective tax obligation write-offs. After using your accountancy to submit your taxes, the IRS might select to execute an audit.

That financing can come in the kind of proprietor's equity, gives, company lendings, and capitalists. Investors need to have a great concept of your organization prior to investing.

The Ultimate Guide To Stonewell Bookkeeping

This is not meant as legal advice; for more details, please visit this site...jpg?token=7cd2150746d7a6091d181e6f1b4de871)

We responded to, "well, in order to know just how much you require to be paying, we need to recognize exactly how much you're making. What is your net revenue? "Well, I have $179,000 in my account, so I guess my internet earnings (profits much less costs) is $18K".

Some Ideas on Stonewell Bookkeeping You Should Know

While it could be that they have $18K in the account (and also that could not hold true), your balance in the financial institution does not always determine your revenue. If a person received a grant or a car loan, those funds are not taken into consideration revenue. And they would not function right into your income statement in establishing your profits.

While it could be that they have $18K in the account (and also that could not hold true), your balance in the financial institution does not always determine your revenue. If a person received a grant or a car loan, those funds are not taken into consideration revenue. And they would not function right into your income statement in establishing your profits.Lots of points that you think are expenditures and reductions are in fact neither. A correct set of books, and an outsourced accountant that can properly categorize those purchases, will assist you recognize what your business is really making. Bookkeeping is the procedure of recording, identifying, and organizing a company's monetary purchases and tax obligation filings.

An effective business needs aid from experts. With sensible objectives and a qualified accountant, you can easily attend to obstacles and maintain those worries at bay. We dedicate our power to guaranteeing you have a solid financial foundation for development.

A Biased View of Stonewell Bookkeeping

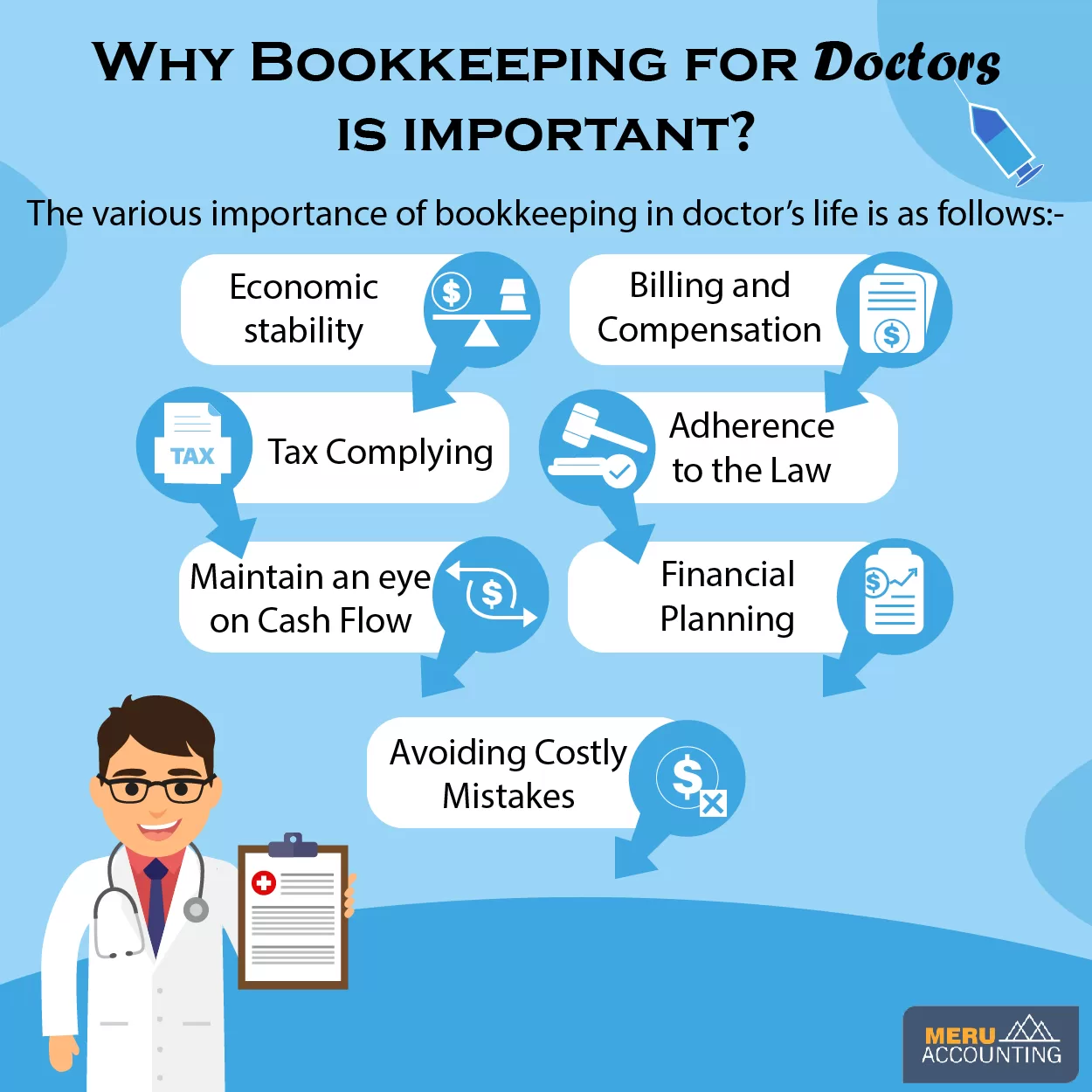

Precise bookkeeping is the backbone of good financial management in any company. It helps track income and costs, ensuring try these out every transaction is recorded correctly. With good bookkeeping, businesses can make far better choices due to the fact that clear monetary records provide valuable data that can lead approach and enhance revenues. This info is essential for long-term preparation and projecting.Accurate monetary declarations build depend on with lenders and financiers, raising your chances of getting the resources you need to grow., services should frequently integrate their accounts.

A bookkeeper will cross financial institution declarations with interior documents at the very least as soon as a month to locate blunders or incongruities. Called bank settlement, this procedure assures that the economic documents of the firm suit those of the financial institution.

They monitor current payroll information, subtract tax obligations, and number pay ranges. Bookkeepers produce fundamental financial reports, including: Profit and Loss Declarations Reveals profits, costs, and web profit. Annual report Details possessions, responsibilities, and equity. Cash Money Flow Declarations Tracks money movement in and out of business (https://yamap.com/users/4989172). These reports assist local business owner recognize their economic position and make notified choices.

Excitement About Stonewell Bookkeeping

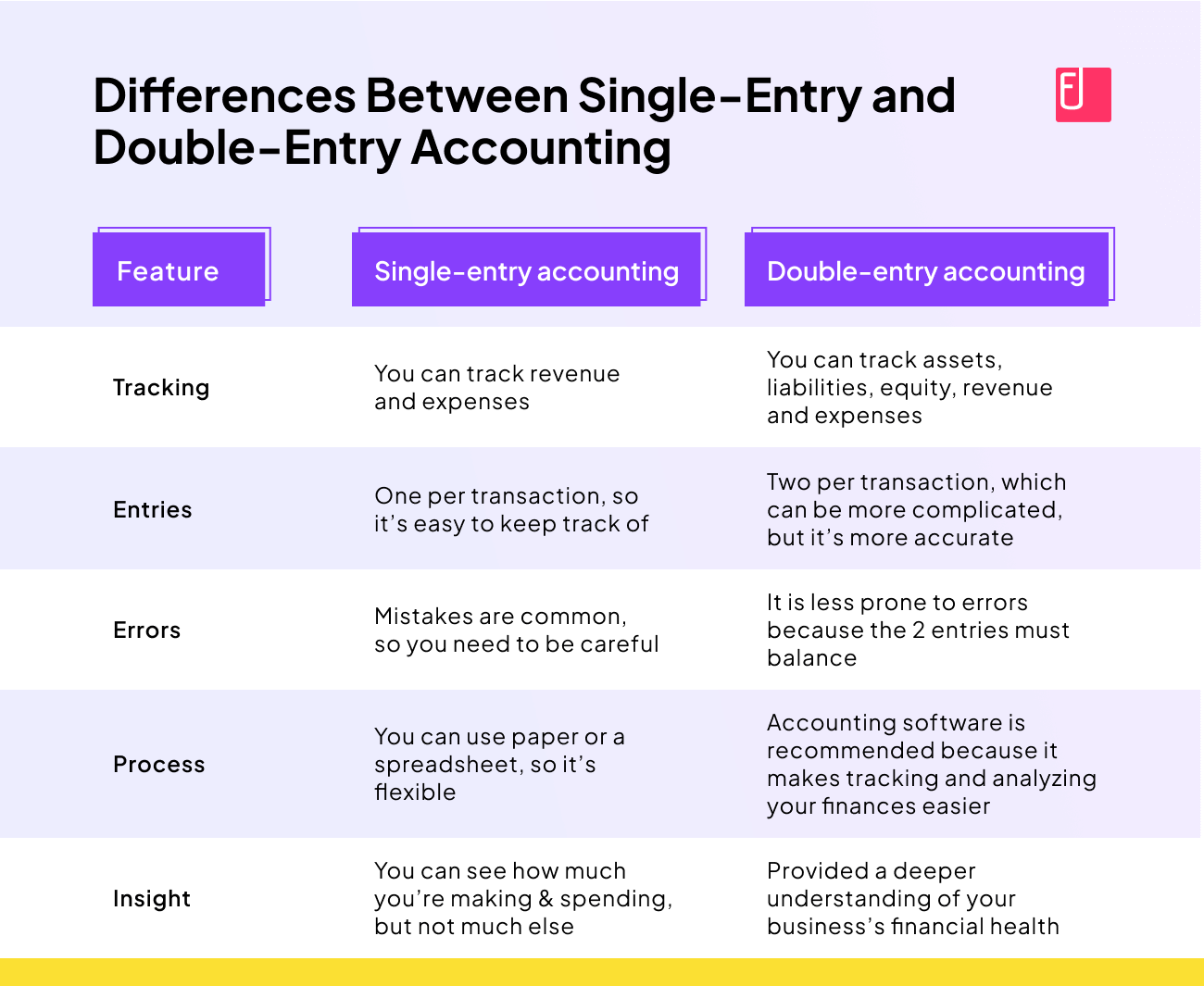

While this is affordable, it can be time-consuming and vulnerable to mistakes. Tools like copyright, Xero, and FreshBooks allow organization proprietors to automate bookkeeping jobs. These programs aid with invoicing, bank reconciliation, and economic reporting.

Report this wiki page